Skills data was inconsistent and of poor quality

Some people entered 100+ skills, others did not even bother at all

About the customer

A large retail & insurance provider, active in more than 6 countries and with more than 35.000 employees globally. The bank is widely considered ahead of the curve in digital transformation with great D-ratings and investments in AI and crypto.

The challenge

This global bank made a big bet on becoming a fully skills-based organisation: they changed various processes to become skill-driven. They implemented a state-of-the-art skills-based employee experience platform. But both the methods and experience platform were underwhelming because of a lack of reliable data.

Some people entered 100+ skills, others did not even bother at all

The organisation wrongly assumed everyone in the same job had the same skills.

HR Managers nor C-level executives trusted the data available to them.

The goal

The CEO wanted to focus on the internal development & reskilling of employees rather than mass terminations/layoffs. The CHRO wanted to be able to report on the reskilling progress and wanted leadership to trust the validity of their data.

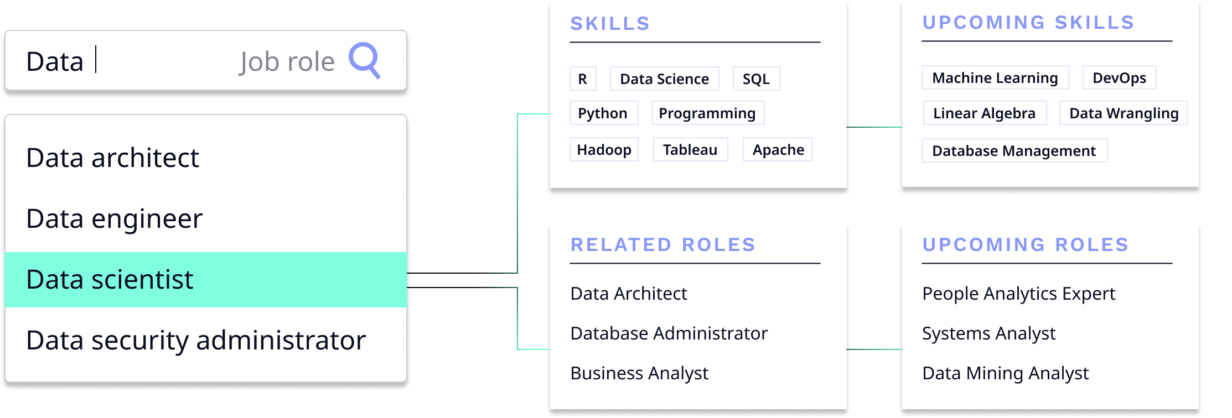

Use data and people's digital footprint to understand which actual skills people have and are used daily

Feed skills data into the existing HR Architecture

L&D wanted to measure its ROI, and demonstrate learning effectiveness & efficiency.

Workforce planning needed to base itself on targeted interventions e.g. recruitment, internal mobility and redeployment...

The solution

The bank first ran a PoC to prove that TechWolf’s skill inference AI could fix their skills data. After a data maturity scan, and with newly quantified skills data, we worked together to design the program for a broader rollout.

TechWolf then helped the company discover the skills problem that was hurting them and offered a solution that perfectly matched their vision of a skills ecosystem. We solved the data problem without introducing yet another employee-facing tool or using surveys or other manual methods.

Employees & managers at the bank evaluated their own skill profiles. The approval rate for the process jumped to 95%.

Skills data improved drastically, both in quality and quantity.

A tangible higher Internal mobility and healthy competition between the internal and external labour market.

The global bank gained a newfound view of its essential skills, including previously hidden ones.

TechWolf not only gave this global bank insights into the skills problem that was hurting them, its CHRO saw that she could use skills data to drive her entire roadmap forward.

Fill in the form and you can watch the recording immediately.

Fill in the form and watch the recording immediately.